Case study

Universal Banking

Our vision for the core of the near future — a core that requires flexibility, extensibility, and scalability. But in addition to the core experience, our vision demonstrates how enabling Banking as a Service plays an invaluable role in how the near- future of finance will be conducted.

Role

Industry

Duration

The Problem

As the banking industry faces unprecedented levels of change, Finastra leadership tasked our user experience team with evaluating the Phoenix retail banking core system against the market influencers and emerging technologies that are driving change in the near-future banking market. The goal — create a vision of a next-gen, retail core banking experience that delivers on the promise of Finastra’s move to the Cloud and support for Banking as a Service.

The Solution

Following months of analysis, 189 customer interviews, and 24 new personas, our team created the first look at a next-gen Universal Banking vision. The focus was to unify fragmented experiences into a single integrated persona-based experience, based on actual use cases. Recommendations included wholesale modernization, personalized tailored experiences, automation, and self services. These innovative solutions set a new standard for modern banking.

Amplify Research Initiative

A critical component to effective solutions is understanding our users, their jobs to be done, and their desired outcomes. We embarked on a 6 month research initiative to do just that, resulting in deeper understanding and innovative proposals.

The Universal Banking Experiences

A series of guided and unguided interactive prototypes were created to showcase 8 different user journeys for the Universal Banking move towards modernization. I was served on 4 of the work streams as a primary designer.

CSR Experience

The role of the CSR is crucial for most banks as they serve as the primary point of contact for customers. They are responsible for handling customer inquiries, resolving issues, and providing information about the bank's offerings. They play an important role in shaping the experience of the customers of the bank.

Executive Experience

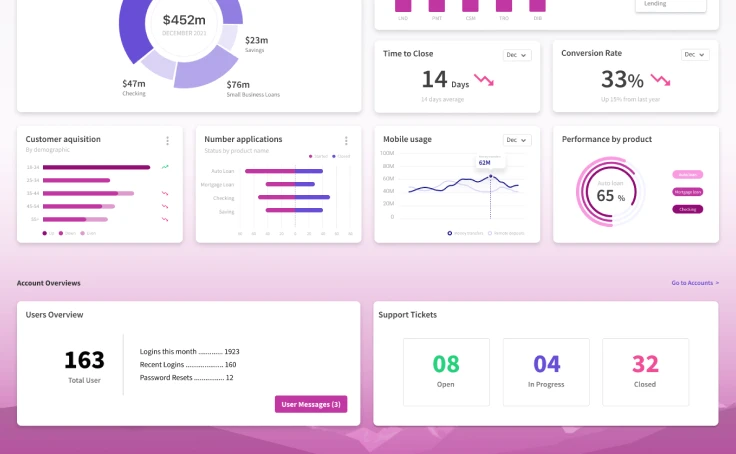

A great executive software experience is essential for bank executives as it enables them to make informed decisions, improve operational efficiency, and maintain a competitive edge in the industry. Bank executives need the right tools to oversee performance and ensure the bank meets its goals and objectives.

Mobile Experience

A positive mobile customer experience is important for banks as it drives customer satisfaction, engagement and loyalty. A well-designed mobile experience that is user-friendly and provides access to essential banking services and features can help banks differentiate themselves and be competitive in the marketplace.

View the Details

Executive Insights

Data insights are critical for bank executives as they provide a comprehensive understanding of the bank's performance, enabling informed decision making and strategy development. With access to real-time data and analytics, executives can identify trends, track progress, and make data-driven decisions that improve the overall performance and success of the bank.

Loan Officer Experience

The loan application process is important as it serves as the foundation for the loan approval process. An efficient, streamlined, and user-friendly loan process can help banks attract customers, improve customer satisfaction, and increase loan volume, contributing to a bank's performance and competitiveness.

Banking as a Service

BaaS enables businesses to leverage their existing customer relationships and tech infrastructure to offer financial services, while outsourcing the underlying banking operations to specialized providers. This results in increased customer engagement, reduced costs, and new revenue streams.